Is Water Damage Covered By Insurance?

Insurance coverage for water damage depends on the specific terms and conditions of your insurance policy. Generally, standard homeowner's insurance policies cover certain types of water damage caused by sudden and accidental events.

However, it's important to note that insurance policies may have exclusions or limitations on coverage for water damage. For example, some policies may exclude coverage for water damage resulting from gradual or ongoing leaks, lack of maintenance, or flooding from external sources like rivers or tidal waves.

To have a clear understanding of your insurance coverage for water damage, it is recommended to carefully review your policy documents or contact your insurance provider directly. They can provide specific information about the coverage, exclusions, deductibles, and any additional endorsements or options available to enhance your coverage.

However, here are some water damage scenarios that are typically covered by insurance policies:

- Water damage caused by sudden and accidental events:

Insurance policies typically cover water damage resulting from sudden and accidental events, such as a burst pipe, malfunctioning appliance, or a roof leak. This coverage ensures that homeowners are protected against unforeseen incidents that can cause significant damage to their property.

- Protection against plumbing system failures: Insurance covers water damage caused by plumbing system failures, including burst pipes, faulty plumbing fixtures, or pipe leaks. Such incidents can lead to extensive water damage and require costly repairs.

- Coverage for appliance-related leaks: Insurance policies often include coverage for water damage resulting from leaks or malfunctions in household appliances, such as washing machines, dishwashers, or refrigerators. These appliances can leak large amounts of water, causing damage to floors, walls, and other structures.

- Weather-related incidents: Insurance typically covers water damage caused by

weather-related events, such as heavy rainstorms, hurricanes, or flash floods. These natural disasters can lead to significant water intrusion into homes, causing damage to the building structure, furniture, and personal belongings.

- Roof leaks: Insurance covers water damage resulting from roof leaks caused by factors like severe weather, aging materials, or improper installation. A compromised roof can allow water to seep into the property's interior, damaging ceilings, walls, and personal possessions.

- Damage from firefighting efforts: Insurance policies often cover water damage from firefighting efforts to extinguish a fire. Although water is necessary to combat flames, it can cause significant damage to the property's structure and contents.

- Accidental water discharge from plumbing systems: Insurance covers water damage caused by accidental discharges from plumbing systems, such as a burst pipe, failed valve, or broken hose. These incidents can occur suddenly, leading to substantial water damage and the need for repairs.

- Overflow or backup of sewers, drains, or sump pumps: Insurance policies often include coverage for water damage resulting from the overflow or backup of sewers, drains, or sump pumps. These incidents can cause contaminated water to enter the property, creating health hazards and requiring extensive cleanup and restoration.

- Protection against accidental water discharge: Insurance typically covers water damage caused by accidental discharge, such as a bathtub overflowing, a toilet malfunctioning, or a waterbed leaking. These incidents can occur unexpectedly and cause significant damage to floors, walls, and belongings.

- Coverage for water damage during construction:

Insurance may cover water damage that occurs during construction or renovation projects. This coverage is important in case water enters the property during construction, causing damage to the building and materials.

- Protection against frozen pipes: Insurance policies often cover water damage from frozen pipes. When pipes freeze, the expanding ice can cause them to burst, leading to significant water damage throughout the property.

- Plumbing-related leaks hidden within walls or floors:

Insurance typically covers water damage resulting from hidden

plumbing leaks within walls or floors. These leaks can go unnoticed for an extended period, causing damage to structural components, insulation, and other materials.

- Protection against accidental water damage caused by guests or tenants: Insurance may cover water damage resulting from accidental incidents caused by guests or tenants, such as leaving a faucet running or causing a plumbing fixture to leak. This coverage helps protect property owners from the financial burden of repairs.

- Coverage for

mold remediation: Insurance policies often cover water damage that leads to mold growth within the property. Mold can develop within 24-48 hours after water exposure, and its presence can cause health issues and extensive damage to building materials.

- Protection against water damage due to vandalism or theft: Insurance may cover water damage resulting from vandalism or theft where the perpetrators intentionally cause water-related damage to the property. This coverage helps homeowners recover from such malicious acts.

- Coverage for damage to personal property: Insurance typically covers water damage to personal belongings within the property, such as furniture, electronics, clothing, and other valuables. This coverage ensures that homeowners can replace or repair their damaged possessions.

- Protection against water damage caused by falling objects: Insurance may cover water damage from falling objects, such as trees or branches, that puncture roofs or break windows during storms. This coverage protects homeowners against the resulting water intrusion and damage.

- Leaking or damaged water supply lines: Insurance policies often cover water damage caused by leaking or damaged water supply lines. These lines can deteriorate over time or get damaged due to external factors, leading to water leaks that cause damage to the property.

- Coverage for damage caused by extinguishing a home fire: Insurance typically covers water damage resulting from extinguishing a home fire, where water is used to suppress flames. This coverage ensures that homeowners are protected from the water damage caused by fire suppression efforts.

- Protection against accidental water damage caused by children: Insurance may cover water damage resulting from accidental incidents caused by children, such as leaving a faucet running or overflowing a bathtub. This coverage provides financial assistance for repairs and cleanup.

- Coverage for water damage caused by accidental sprinkler activation:

Insurance policies often cover water damage resulting from accidental activation of sprinkler systems, whether due to equipment failure or human error. This coverage ensures that property owners are protected from the resulting water damage.

- Protection against

water damage caused by hailstorms: Insurance typically covers water damage from hailstorms, which can damage roofs, windows, and other parts of the property. Hailstones can create openings for water to enter, leading to subsequent damage.

- Coverage for damage caused by water main breaks: Insurance may cover water damage resulting from water main breaks that occur outside the property. These incidents can cause flooding, affecting multiple properties and leading to substantial water damage.

- Protection against water damage caused by foundation leaks:

Insurance policies often cover water damage resulting from foundation leaks, where water seeps through cracks in the foundation. This coverage protects homeowners from the resulting water intrusion and structural damage.

- Coverage for damage caused by accidental swimming pool or hot tub leaks: Insurance typically covers water damage resulting from accidental leaks in swimming pools or hot tubs. These incidents can release a significant amount of water, potentially causing damage to the property and surrounding areas.

- Protection against water damage caused by sprinkler system malfunctions: Insurance may cover water damage resulting from malfunctions in automatic sprinkler systems, such as faulty valves or sensors. This coverage protects property owners from the damage caused by unintended water discharge.

- Coverage for damage caused by watercraft accidents: Insurance policies often cover water damage resulting from accidents involving watercraft, such as boats or jet skis. In case of accidents that lead to water intrusion, this coverage helps homeowners repair the resulting damage.

- Protection against water damage caused by accidents during moving: Insurance policies often cover water damage from accidents during the moving process. This coverage protects homeowners' property in case of incidents like water spills or leaks during transportation.

It's important to note that insurance policies can vary significantly in terms of coverage and exclusions. The specific details of coverage for water damage can be found in the policy documents provided by your insurance provider.

If your home has water damage, it may be time to hire a professional. And here’s why:

Hiring a professional to handle water damage is essential for several compelling reasons. Firstly, professionals possess the expertise and experience to accurately assess the extent of the damage, identify potential hidden issues, and develop an effective restoration plan. Their knowledge ensures that no underlying problems are overlooked, preventing future complications.

Additionally, professionals are well-versed in handling insurance claims, assisting you in navigating the often complex and time-consuming process. Their guidance ensures that you receive fair compensation for the damage incurred. Hiring professionals saves you valuable time and effort, as they efficiently manage all aspects of the restoration process, from initial assessment to final repairs.

Pro-Care Restoration Can Help!

If your home has been damaged by leaking pipes, faulty appliances, storms, or anything else,

contact the experts at ProCare Restoration. We are fully licensed and IIRC certified. We can handle commercial and residential water damage and also offer fire restoration services. We offer 24/7 services, so call as soon as you notice any symptoms of water damage in your home.New Paragraph

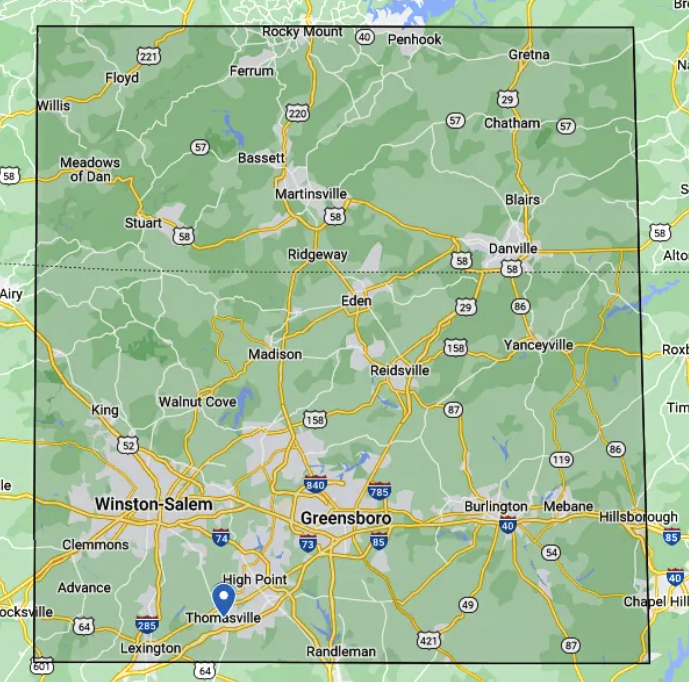

Serving North Carolina

& Southern Virginia

Eden, NC

Madison, NC

Yanceyville, NC

Reidsville, NC

Walnut Cove, NC

King, NC

Winston-Salem, NC

Greensboro, NC

Burlington, NC

Mebane, NC

Hillsborough, NC

Clemmons, NC

Advance, NC

High Point, NC

Thomasville, NC

Lexington, NC

Randleman, NC

Rocky Mount, VA

Penhook, VA

Floyd, VA

Ferrum, VA

Gretna, VA

Willis, VA

Chatham, VA

Meadows of Dan, VA

Bassett, VA

Martinsville, VA

Blairs, VA

Stuart, VA

Ridgeway, VA

Danville, VA